The Ultimate Guide To Buying an HRMS for Banks

Emerging HR Trends in the Banking Sector

The banking industry is on the path to transformational growth, with an aggressive growth mandate. The global banking industry hit US $2.48 trillion in 2021 and US $2.67 trillion in 2022. This growth is only positioned to speed up in the coming decade.

The industry is also witnessing various events that will drive this growth and shape the future of banking such as the rise of remote working and digitalization, rigorous regulatory compliance, the revitalization of HR policies, talent management, etc. The HR function at banks are a critical resource for handling the impact of these events and spearheading growth in the banking sector. From streamlining operations to managing the industry’s persistent challenge of talent acquisition and attrition, HR leaders have several major responsibilities ahead of them.

The role of HR in banking is shaping up to be far more exciting and strategic than in the past. Digitization and digitalization are among the key priorities, and the top goal for HR departments at banks will be assisting leadership and staff in managing digital disruptions to build an agile, collaborative, and learning-focused organization.

Banks are increasingly adopting intelligent technology to save costs and increase process efficiency and customer satisfaction. It is time for leaders to reimagine the work that their workforce can accomplish using intelligent technology.

An end-to-end, module-based, highly configurable HRMS platform can be a great asset for the HR function in the banking industry. Only the right HR tech platform, built to meet the evolving needs of banks and financial institutions, can help you truly unlock your bank’s growth potential.

The Road to HRMS Transformation

Buying an HRMS for your organization is a process that involves taking multiple factors into consideration, starting from the needs of your organization, to ensuring the vendors you’re evaluating follow industry best practices, privacy requirements, etc.

This section takes you through every aspect of an HRMS that you need to consider.

01 Evaluate the Needs of Stakeholders

An HRMS solution is the only business software that touches every person in the bank. Every stakeholder in the ecosystem seeks and requires different things from the system. It is important to zoom out and consider all stakeholders involved in the process and note how the change will benefit each of them.

Here’s an overview of the issues each person in the ecosystem faces and what an ideal HRMS solution can provide them.

Download the Persona Document 🤞

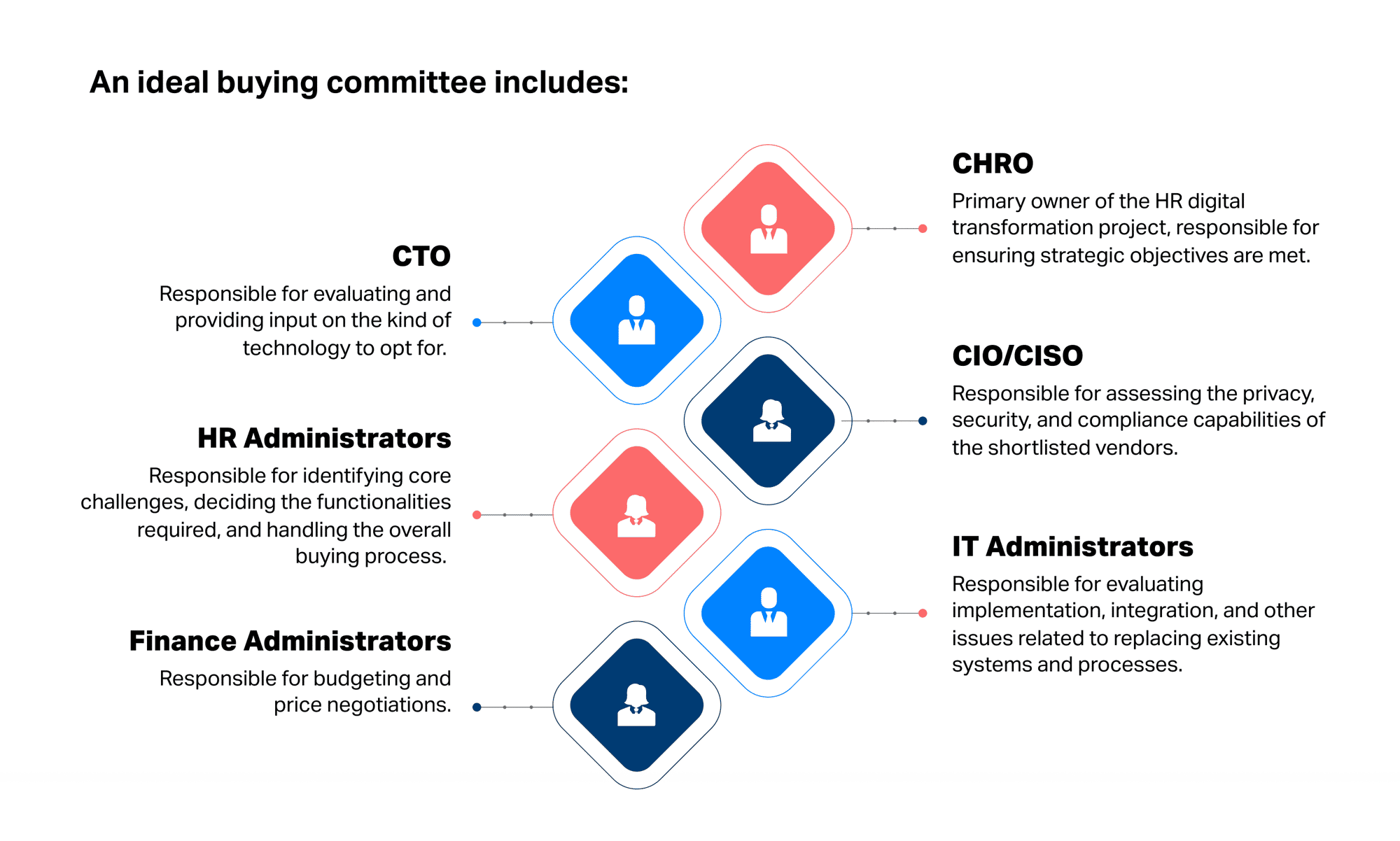

02 Set Up a Buying Committee

Revamping your company’s HRMS is a major task and requires involvement and support from multiple teams outside the HR function. While ultimate ownership typically rests with the CHRO, multiple other stakeholders will have to actively participate in the project to ensure a smooth, efficient transition.

Before embarking on the process of implementing a new HRMS system, the HR team should set up a cross-functional buying committee that will work closely with the HR team to decide which HRMS vendor to partner with.

03 Identify Vendors & Solution Providers

The market is flush with products and solutions of all kinds, but there are certain functionalities that are essential for the kind of workforce present at banks, and for the unique needs of employees in the banking sector. Here’s how you can filter out the broad categories before you shortlist vendors you can speak to in-depth:

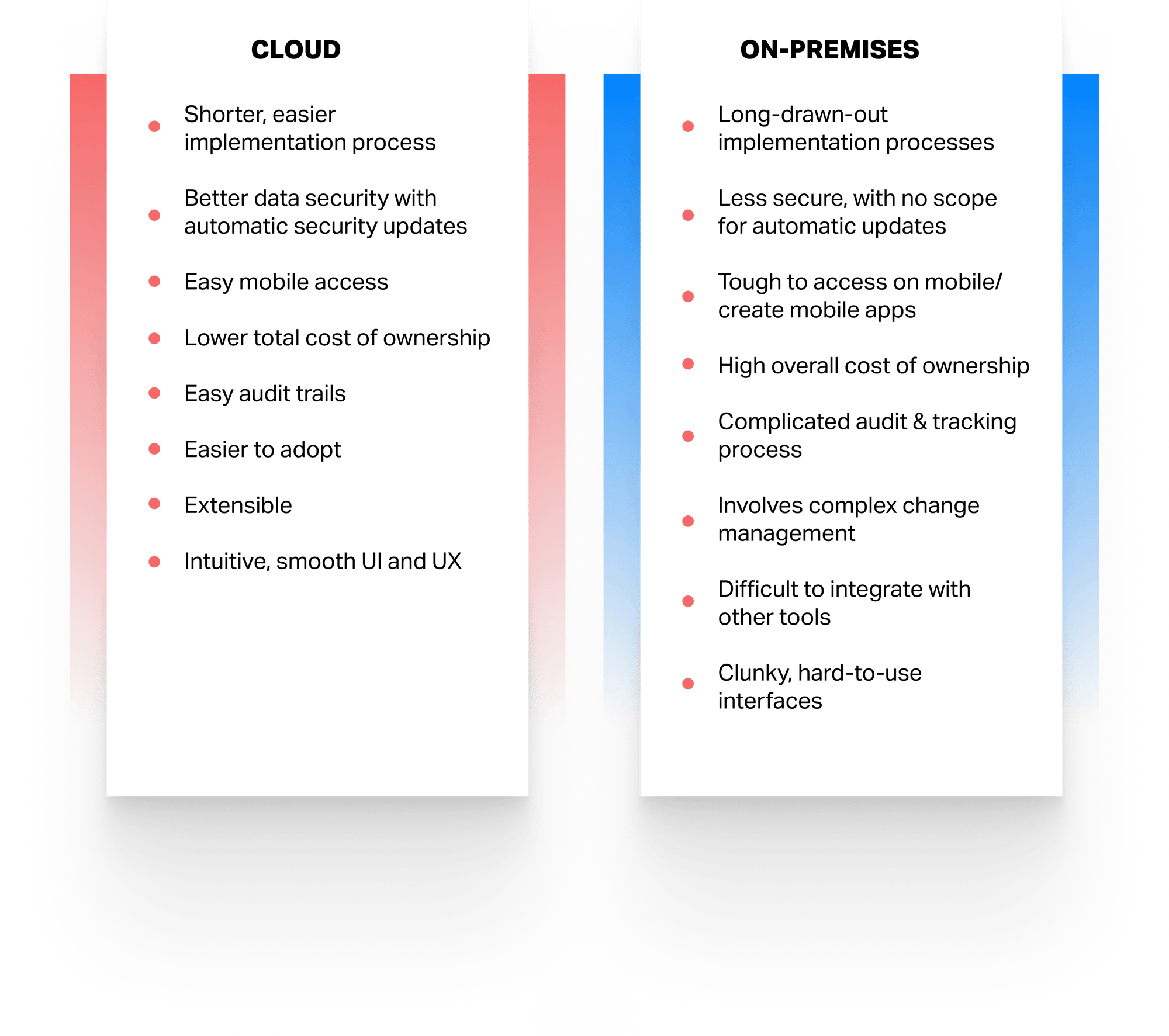

Cloud Vs. On-premises Solutions:

The buying committee will have to start with filtering vendors based on the technology their products are built on. The technology architecture and foundation – whether it is cloud-based software or an on-premises one – determine how a solution is implemented, adopted, and updated for at least a decade. Ever since the pandemic hit, however, there’s been a sharp increase in migration to the cloud.

Here are some key aspects to consider:

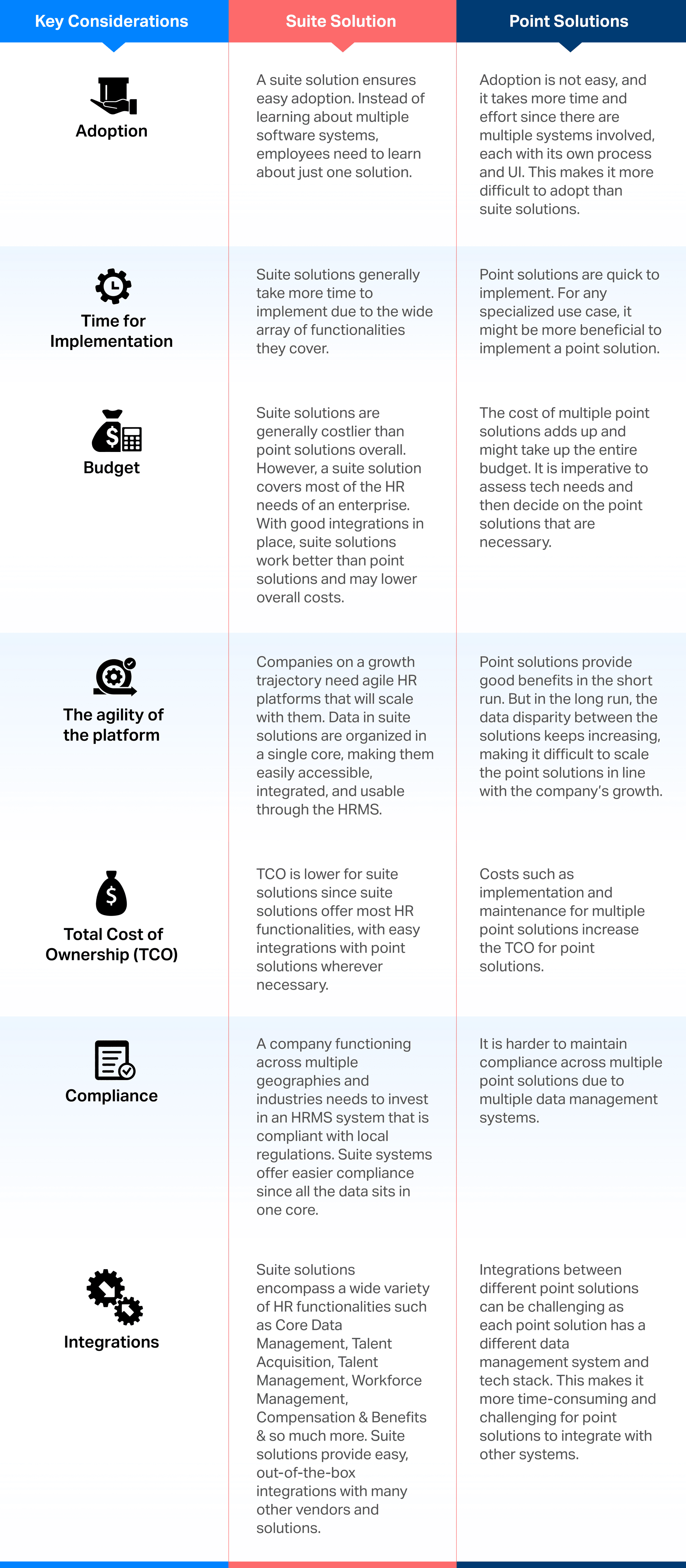

Suite Vs. Point Solutions

Once the type of solution is decided, the core committee should look at the breadth of functionalities the solution will offer. The market either offers point solutions that address one challenge or serve one function within an organization or suite solutions that serve all functions on one common platform.

In the HRMS context, an end-to-end suite typically serves all internal HR functions across the employee life cycle including hiring, recruitment, onboarding, time and attendance, payroll, performance management, analytics, and separation.

Here are some key aspects to consider:

Privacy, Security, and Compliance

Banking and financial services companies are governed by strict regulations and have a host of policies they must comply with. With the sector evolving rapidly and the growing popularity of hybrid work, HR professionals have more legal and regulatory issues to deal with – both with employees/labor laws and the use of technology and data. There’s also a need for banks to strengthen their cybersecurity and data security systems and equip their IT teams to comply with data privacy and security regulations across the globe.

Data Privacy: Banks hold a lot of sensitive data about customers, both personal data such as name and addresses, and financial data. They are a plum target for cybercrime, and companies need to consider adding another layer of security to handle this. The security systems need to be powerful, agile, and up to date.

Global and Local Regulations: It is critical to implement an HRMS solution that is in compliance with regulations such as GDPR, SOC 2, SOC 1, ISO 27001/22301, etc. Moreover, these regulations change quite frequently, and it is as important for HRMS providers to be agile in responding to the updates and making changes to workflows or processes in the platform.

Share this perspective with your CIO/CISO for their consideration and input.

Share this perspective with your CIO/CISO for their consideration and input.

Agility

The world of work is changing faster than ever, and an HRMS must be agile and be able to keep up with changing requirements.

The banking sector was among the worst-hit industries when the pandemic stifled economic activity. The current tight economic situation is not helping with recovery either. It is essential for banks to rework their processes and reduce operating costs by improving agility. There are initiatives and process change that HR leaders must take on to cut costs and improve efficiency.

Agile Platform: An HRMS system’s technical architecture should be robust and nimble enough to change and deploy code in run time without any disruption to the regular functioning of the organization.

Agile Processes: The vendor deploying the HRMS platform should be able to optimize your existing processes before the new software is brought in. Post-implementation, workflows must be smooth to run, and new business processes must be easy to configure.

Agile People: When operating with a diverse and remote workforce, agility is important. Next-gen software will, for instance, ensure that people have easy access to relevant information so they can take faster business decisions.

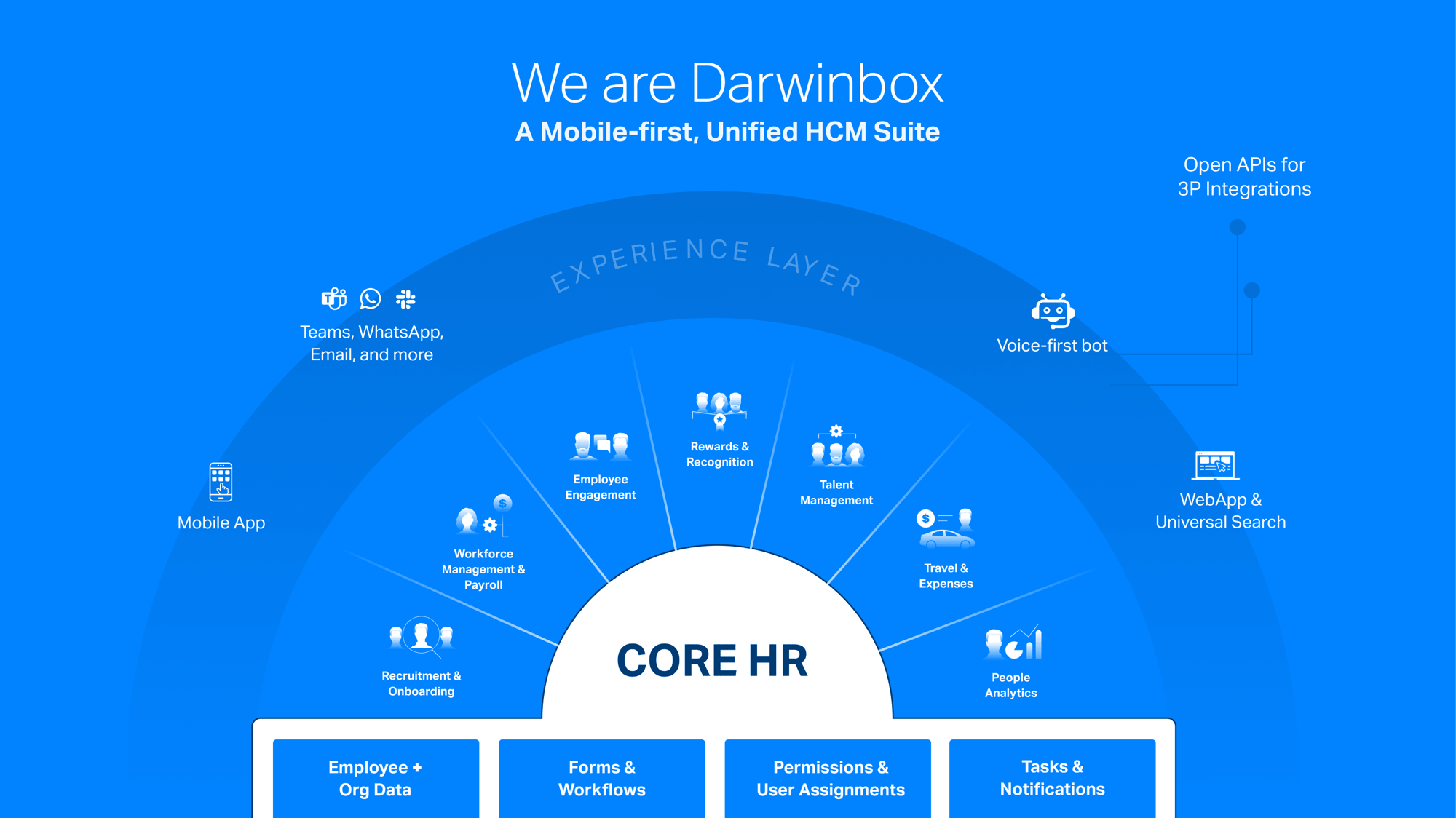

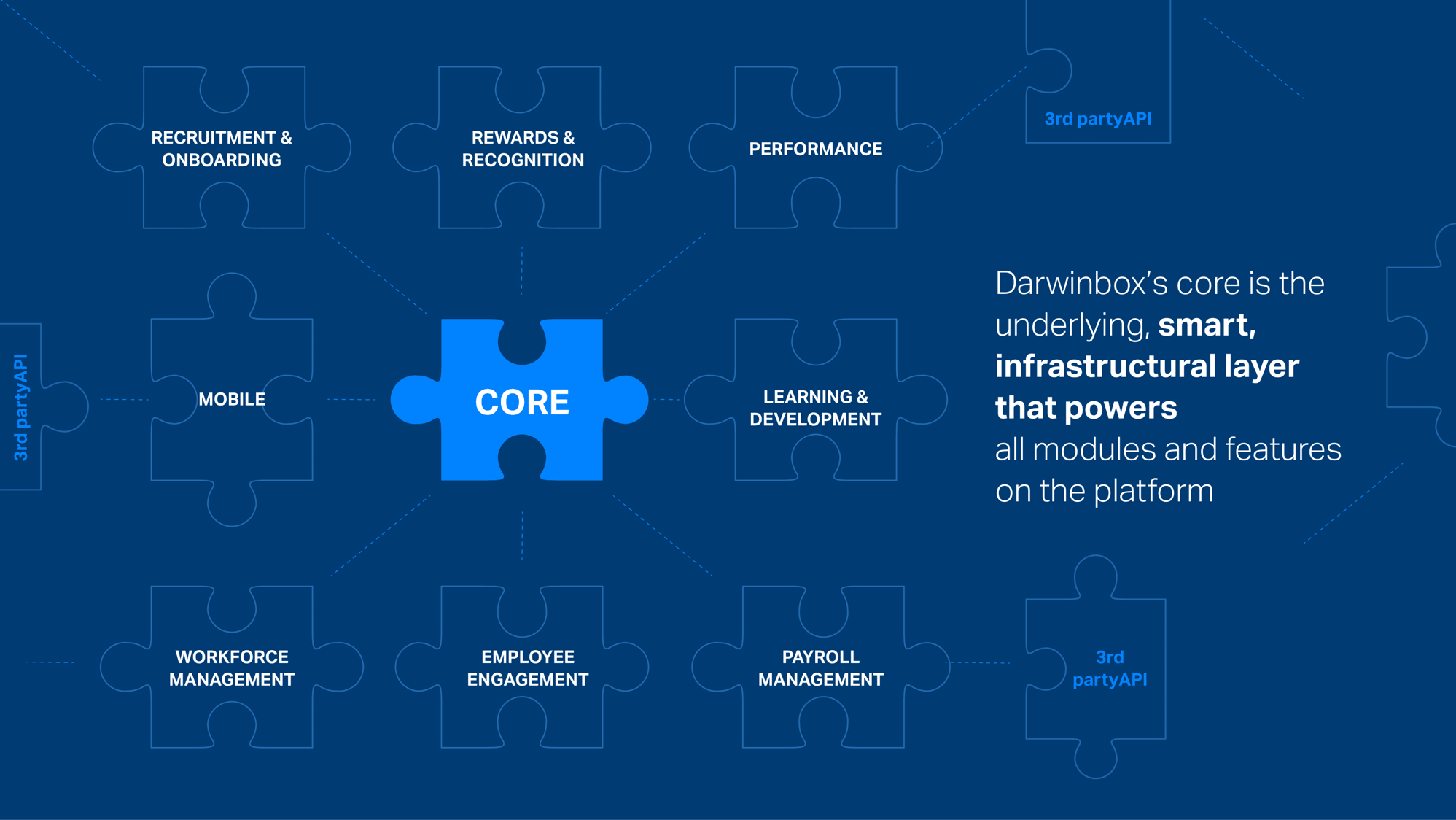

A Unified Ecosystem

The HRMS, being the platform that touches every employee in the organization, needs to integrate with several other systems within an organization, such as CRM or ERPs.

Banks particularly work with mountains of employee data, which are stored in multiple, disparate systems. Both within the HRMS platform and through integration with other systems, there is a lot of data collected and a lot of processes interlinked. It has become essential to select an HRMS that can unify all components in the ecosystem.

A modern HRMS platform can bring all this data together and serve as a single source of truth for the organization. A central HR database will also help improve efficiencies across all HR functions. If processes and organizational structures can be consolidated, collaboration across units will improve, and duplication of efforts can be eliminated.

A unified ecosystem can be created if an HRMS is composable in its fundamentals. The HRMS solution should ideally be composed of modular components for each segment of the employee lifecycle. This helps HR leaders customize the solution based on the requirements of their banking institution and their workforce.

An ideal HRMS system should also be one that can easily integrate with third-party applications through APIs. This will enable HR leaders to collect and analyze historical data and work with information from across systems.

Ensure the platform is extensible and integrates with other software that are core to your company’s business.

Ensure the platform is extensible and integrates with other software that are core to your company’s business.

Configurability

While taking on such a massive transformation project, HR leaders must ensure that the HRMS vendor provides you with the power to configure their platform without needing to depend on the vendor or your company’s IT team. You should be able to transform the basic HRMS into a solution that suits the different functions, structures, and business processes within your organization. A flexible, and configurable HRMS is extremely important to ensure that HR leaders and administrators can manage their workforce efficiently.

Support various pillars of configurability: Organization structure, location, employment type, cost center, business unit, department, etc. should be easily configurable.

Low code or no code methodology: Low or no-code tools give the power to configure to HR leaders. They should be able to set up the HRMS solution in a manner that will solve their challenges and help them function more efficiently. An HRMS platform that is heavy on code and engineering will increase dependency on the IT teams, slowing down the process.

Smooth Adoption

Widespread adoption is essential to unlock the true potential of an HRMS system and derive maximum returns. The importance of this is accentuated in the banking sector given that a majority of the workforce are deskless workers, in stores, and use the HRMS on mobile and aren’t too tech-savvy. An HRMS that has a simple, intuitive UI and is designed for quick adoption, on mobile, is essential for banks.

There are a few characteristics of an HRMS platform that will make it easy to adopt:

Simple and intuitive UI

Simple and intuitive UI

End-user focused design for functions like document access, workflows, etc.

End-user focused design for functions like document access, workflows, etc.

Nudges, notifications, and guides within the product

Nudges, notifications, and guides within the product

Push notifications

Push notifications

Custom branding and personalization

Custom branding and personalization

Frictionless processes – it doesn’t take more than three clicks to complete a task

Frictionless processes – it doesn’t take more than three clicks to complete a task

Voicebots and chatbots

Voicebots and chatbots

Ask the HRMS provider about their design thinking framework, so you can gain insights into their approach to building product modules and the platform.

Ask the HRMS provider about their design thinking framework, so you can gain insights into their approach to building product modules and the platform.

Mobile Functionality

A mobile app is no longer an optional feature for HRMS solutions. Mobile access to HR tasks such as time and attendance, leaves, helpdesk, etc. is extremely important to ensure adoption across the company, especially for banks.

Most people today are used to working with mobile apps for daily tasks and prefer a similar experience with their work tasks. Having a mobile app and providing HR services such as attendance, leave requests, travel and expense requests, etc. will dramatically improve adoption levels among employees.

Next-gen, unified HRMS platforms are built to offer HR services on the mobile app, for everything from daily tasks such as attendance or leave requests, to helpdesk access or availability of L&D material on mobile. Tasks such as sending and accepting offer letters can be done on mobile as well, making it easier and more efficient while hiring in bulk, and hiring across regions.

Here are some ideal characteristics of an HR mobile app

Intuitive and easy to use

Intuitive and easy to use

Lightweight

Lightweight

Supports facial recognition

Supports facial recognition

Voicebot and chatbot enabled

Voicebot and chatbot enabled

Geotagging and geofencing enabled

Geotagging and geofencing enabled

Supports QR codes

Supports QR codes

Integrates with apps like WhatsApp

Integrates with apps like WhatsApp

Supports learning & development (L&D) programs on mobile

Supports learning & development (L&D) programs on mobile

Provides access to basic HRMS functionalities

Provides access to basic HRMS functionalities

Document discovery for easy policy access

Document discovery for easy policy access

Democratizing Access & Visibility

In 2020, every person on earth generated 1.7 megabytes of data in just a second, as per estimates by IBM. Organizing and analyzing all this data is a useful, important function in most organizations. Efficient and regular data analysis can yield rich, actionable insights to improve productivity and efficiency in processes. not misused.

For banks to be able to make the best use of their data, their HRMS needs to enable them to democratize access to said data. There’s a need for a streamlined approach that puts the power in HR’s hands.

It is important to deploy an HRMS that enables HR leaders to set up role-based data access to empower employees with contextual data and actionable insights. An ideal solution is one which supports robust reporting and analytics, and provisions for role-based and permission-based access to data.

For example, HR managers must be able to configure access such that only employees in certain roles or employees with specific permissions can access internal documents and confidential data.

With access comes the need for monitoring. HRMS solutions that support data democratization must also ensure security and access controls so the data are not misused.

Constant Innovation

Taking up an HR digital transformation project is a long-term investment, and HR leaders need to ensure that the HRMS they opt for promises consistent innovation and improvement.

Technologies such as artificial intelligence and machine learning can be configured for specific applications. For example, they can be used to identify biases while hiring employees and ensure workplaces are diverse and inclusive. You should check if the vendor has plans to use these advanced technologies to launch additional features in the future.

Vendors who have plans to launch such features on the mobile app should be given extra points during the shortlisting process since advanced mobile-based features are particularly useful for banks.

In addition to having innovative, new-age features on the platform, the HRMS should also provide integrations with ERPs and have a vibrant marketplace to integrate with apps. Seamless single sign-on with multiple tenants and integration with basic tools such as calendars, etc. will result in a better employee experience.

Ask the HRMS provider for product feature release schedules, and access to their product team.

Ask the HRMS provider for product feature release schedules, and access to their product team.

Implementation Support

A digital transformation project won’t be a success without a solid implementation plan in place.

The process entails

-

Project scoping

-

Resource allocation

-

Integrations

-

Training

-

Customer support

What to include in change management?

-

Data migration and smooth flow of data between modules

-

Integration with other business software

-

Understanding of global and local complexities

-

Training and consultation

-

Clear, detailed change management plan

What to include in change management?

![]() Bring people along and prepare themCreate a process to bring people along & prepare them for the new HRMS

Bring people along and prepare themCreate a process to bring people along & prepare them for the new HRMS

![]() Communicate & keep people engengaged Consistently communicate to people on the progress & changes, provide regular updates to key stakeholders

Communicate & keep people engengaged Consistently communicate to people on the progress & changes, provide regular updates to key stakeholders

Minimize impact on people’s roles & responsibilitiesProvide adequate support & training to people to manage the change impact of new HRMS on their existing way of working

Minimize impact on people’s roles & responsibilitiesProvide adequate support & training to people to manage the change impact of new HRMS on their existing way of working

![]() Increase adoption & sustain new ways of working Understand people readiness for the new HRMS. Conduct dipsticks to action any additional care required.

Increase adoption & sustain new ways of working Understand people readiness for the new HRMS. Conduct dipsticks to action any additional care required.

Ensure that promises made during sales calls are delivered during implementation.

Ensure that promises made during sales calls are delivered during implementation.

Product Training and Admin Self Service

Even after an HRMS is implemented, HR teams sometimes face issues while using the system, or while configuring it for their business needs, etc. To prevent this, it is important to ensure that the vendor you opt for offers sufficient product training sessions. Solutions that offer administrator self-service options are ideal, since this empowers HR to use the tool as required.

The implementation process should include detailed, intensive training sessions for HR and IT teams. A robust customer enablement process should be baked in so administrators can take charge once the implementation is completed.

HRMS systems should be designed to empower HR leaders/administrators to handle the entire system with minimal dependence on IT teams or other implementation specialists.

Customer Support

It is important to ensure that the HRMS provider isn’t solving only for immediate needs but can forecast and work on future needs as well. The HRMS solution should be designed and implemented as a joint, collaborative project that extends beyond the implementation phase. The vendor team should work with you to handle change management and drive success at each touchpoint of the lifecycle.

Initiatives from the vendor to provide ready-to-use templates, toolkits, and other aids that help the bank customize and use the product’s functionalities should be given brownie points during the evaluation process.

Here’s a checklist you can use to assess if the quality of customer support and service the HRMS vendor is offering is top-notch:

-

Data migration and smooth flow of data between modules

-

Accessible – 24/7 chat support

-

Friendly and customer-first

-

Responsive with short SLAs

-

Self-service capabilities

-

Regular check-ins with the customer success manager

-

Up-to-date knowledge bases

Check with the vendor if they provide customer support themselves or rely on an external implementation partner for support.

Check with the vendor if they provide customer support themselves or rely on an external implementation partner for support.

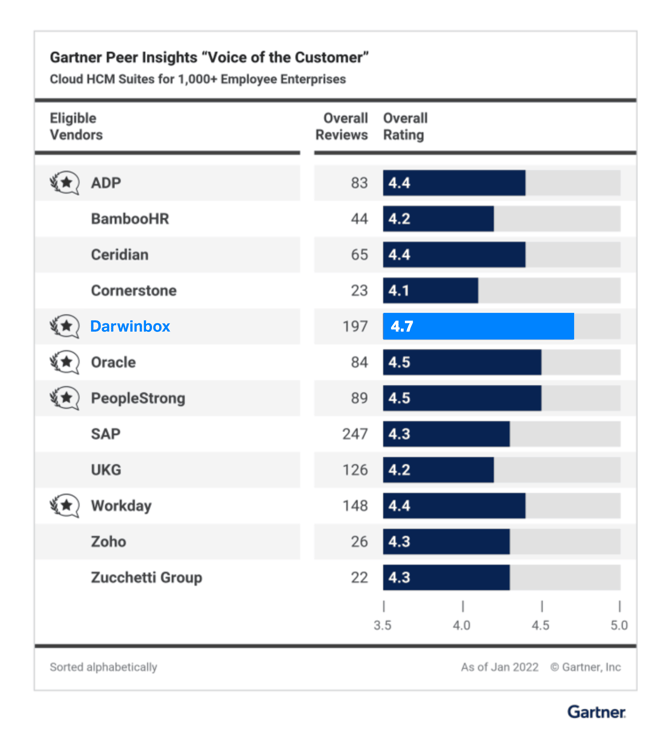

Analyst Ratings

Independent, third-party analyst opinions and recommendations will be of great help when you have a shortlist of vendors and want to narrow the list down. Industry analysts, both independent professionals and those from firms such as Gartner, Forrester, etc., spend a lot of time with HRMS providers and share their expert evaluations of the different brands in the market. You will find detailed reports from them touching upon every aspect of the company, starting from their current offerings, vision, customer reviews, etc.

These analyst ratings and reports will provide you with a neutral, unbiased picture of the landscape and help with decision-making.

04 Request For Proposal

Once the core decision-making committee has evaluated the needs and has narrowed down the universe of options to choose from, the request for proposal (RFP) process follows.

A comprehensive RFP template will include:

01HR technology features that need to be part of modules

02Data and security evaluation checklists

03List of remote work features to win in the post-COVID world

Based on insights from in-depth consultations with top HRMS project managers, Darwinbox has put together an exhaustive list of requirements to help banks find the best, most suitable HRMS.

Download the Persona Document 🤞

Top HRMS Solution Providers in the Market

The market has dozens of vendors who promise to meet many of your requirements. Here’s a list of the top 12 vendors in the market today. The list is compiled by independent technology research and consulting firm Gartner, based on customer feedback; you can go through the detailed document here.

05 Product Demos

Most HRMS providers offer detailed product demos that will help you better understand the functionalities of the product.

However, it is important at this stage to spend time with the sales or pre-sales team to explore how the product can be configured based on your workforce and business process requirements.

Banks should put forth real business scenarios and challenges they want to solve for and evaluate how each product responds to the requirements. They can, for instance, compare how different HRMS platforms handle project management for a remote worker, their attendance tracking, and the contextual policies assigned to them. This will help further narrow down the universe to the most suitable handful of vendors.

This step can also be a great opportunity to evaluate the vendor’s customer centricity, support process, empathy, and values, all of which will help decide if they will be the right HRMS partner for you.

This step can also be a great opportunity to evaluate the vendor’s customer centricity, support process, empathy, and values, all of which will help decide if they will be the right HRMS partner for you.

06 Pricing

By this stage, most of the heavy lifting will be done, and the numbers will have to speak. There are different kinds of pricing models you will see in the market. Typically, HRMS solutions are priced depending on the size of your business – you are charged depending on the number of employees you have.

01PEPP model or per employee per processing model where your annual fee is a product of the number of payment transactions per payroll, times the number of payrolls each year.

02PEPM model or per-employee per month model, where you’re charged by the number of employees on a monthly basis.

03Some vendors also offer a combination of the two, based on the services they provide.

Most HRMS providers also charge initial setup fees, implementation fees, and integration fees.

It is important to collect all the details from the vendor about the pricing model they’re offering you and get a clear picture with specifics about every service that is charged and sold to you.

Read the fine print and draw up a pros/cons list for all vendors on your shortlist to enable you to evaluate efficiently. It is easy to miss or overlook additional costs that vendors charge for training, maintenance, etc. Be sure to clarify these upfront!

Read the fine print and draw up a pros/cons list for all vendors on your shortlist to enable you to evaluate efficiently. It is easy to miss or overlook additional costs that vendors charge for training, maintenance, etc. Be sure to clarify these upfront!

07 Negotiation & Contracting

Once you’ve spent enough time understanding their pricing model, you’re ready to enter negotiations with the HRMS providers you’ve shortlisted.

Negotiation is an art by itself, but here are a few things you can keep in mind while negotiating.

![]() Sales professionals are expert negotiators, have a team of experts who can add their point of view and market knowledge to the negotiation conversation.

Sales professionals are expert negotiators, have a team of experts who can add their point of view and market knowledge to the negotiation conversation.

![]() Evaluate the total cost of ownership, not just the monthly software costs. Consider additional costs and one-time charges when you’re working on your budget.

Evaluate the total cost of ownership, not just the monthly software costs. Consider additional costs and one-time charges when you’re working on your budget.

![]() There’s a lot more to working with an HRMS platform than the basic software. For instance, the customer success team will be working closely with you even after implementation and it is important to have a good working relationship with them. Similarly, it is important to have access to their product team. Be sure to work these intangibles into your ROI calculations.

There’s a lot more to working with an HRMS platform than the basic software. For instance, the customer success team will be working closely with you even after implementation and it is important to have a good working relationship with them. Similarly, it is important to have access to their product team. Be sure to work these intangibles into your ROI calculations.

![]() Be honest about your budget, expectations, and considerations. Let each vendor know that you’re considering others and will choose what is best for your bank.

Be honest about your budget, expectations, and considerations. Let each vendor know that you’re considering others and will choose what is best for your bank.

The numbers matter, yes, but sometimes there’s more to a product than money. Be sure to take the product vision, team, implementation support, etc. into consideration while negotiating, even if these come at a premium.

The numbers matter, yes, but sometimes there’s more to a product than money. Be sure to take the product vision, team, implementation support, etc. into consideration while negotiating, even if these come at a premium.

Calculating the ROI on Your HRMS

Pinning down ROI numbers from HR software can be a complex task given that a lot of benefits a company receives from an HRMS are intangibles. Here’s a template you can use to calculate the ROI you will receive from investing in an HRMS.

You can also explore this guide for a systematic model to calculate the ROI of an HRMS, the metrics that need to be measured and where to find them, along with tips on how to make the case for an HRMS to decision-makers in your bank.

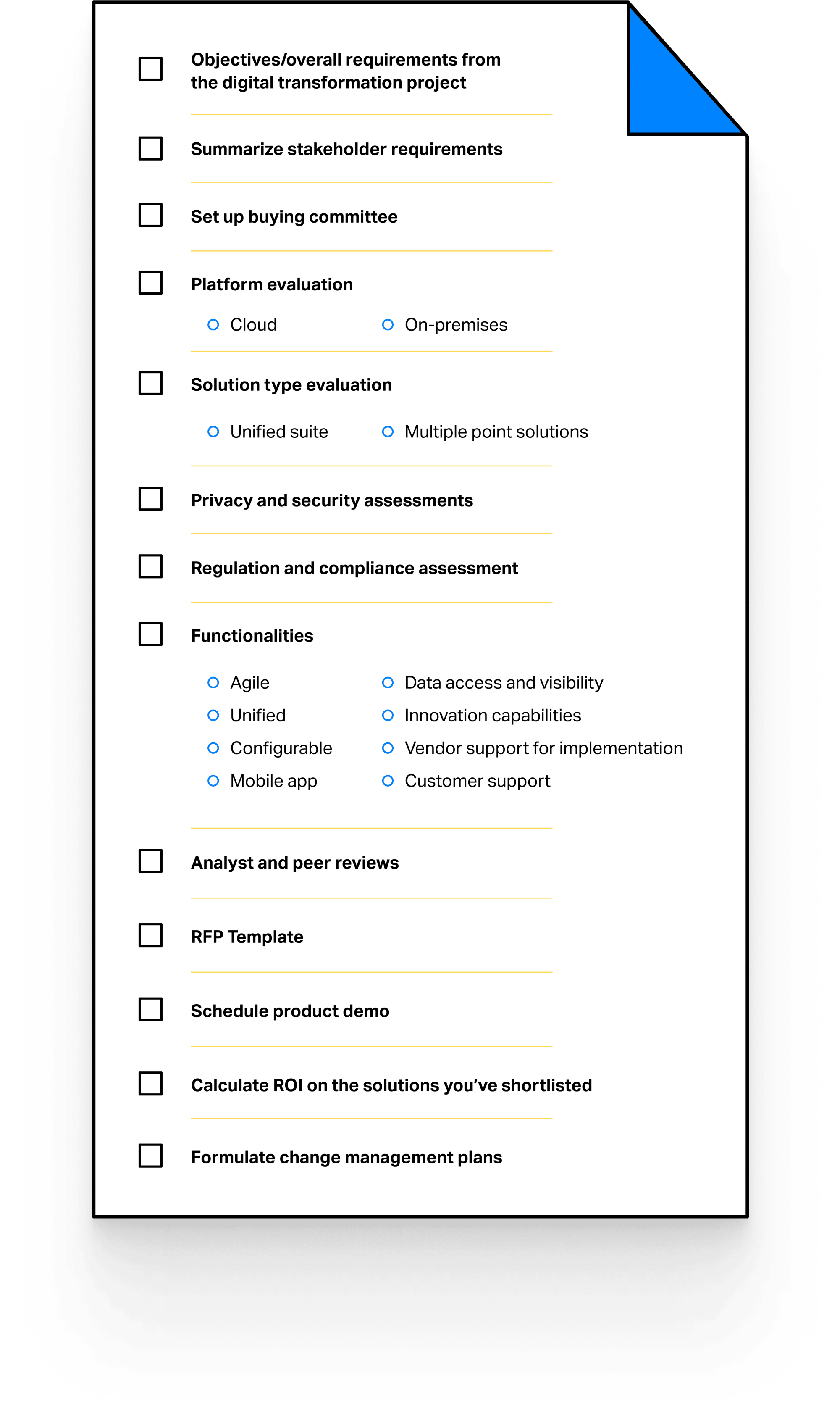

You’re now ready to put into action all the knowledge you’ve gained in the previous sections of the guide! Here’s a checklist you can print and use as you step into the buying process.

Darwinbox’s mobile-first, end-to-end HRMS can help with your HR digital transformation and enable you to unlock your workforce’s potential to win in the new world of banking.

Leading banks and financial services organizations across Asia such as SBI General, YES Bank, Ujjivan, Kotak Life, etc. use and love Darwinbox, and say they’ve had great success with the Darwinbox HRMS.

Ready to revamp your organization’s HRMS? Explore Darwinbox for Banks here.