The Ultimate Guide

to Buying Enterprise Payroll Software

Download the Guide

In this ebook, you will learn:

- Why payroll is such a complex process and the different stages involved in it

- What are some of the most common challenges of payroll processing

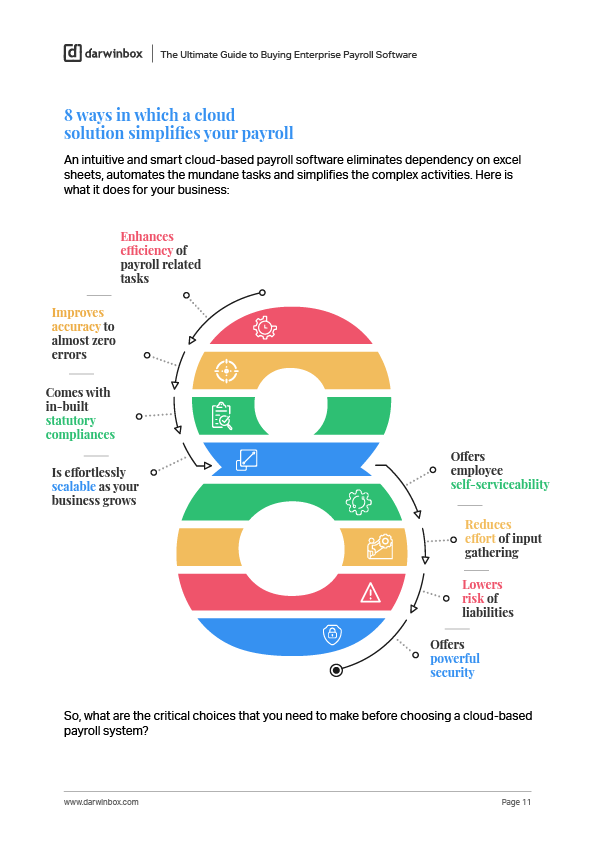

- Why cloud-based solution is your best bet and how it simplifies your work

- What are some of the critical choices you need to make and must-have features to look before buying the right software

- How some of the leading organisations have leveraged the power of cloud-based payroll